What is Computer Networking? | Beginner’s Guide for 2025

Apr 08 2025 | Written by CISCO

Welcome to our blog! If you’ve ever wondered how your phone connects to Wi-Fi, how companies share files across different offices, or how the internet even works — you're already curious about computer networking.

In this post, we’ll explore what computer networking is, why it’s important, and how you can start learning it — whether you’re a student, IT enthusiast, or just tech-curious!

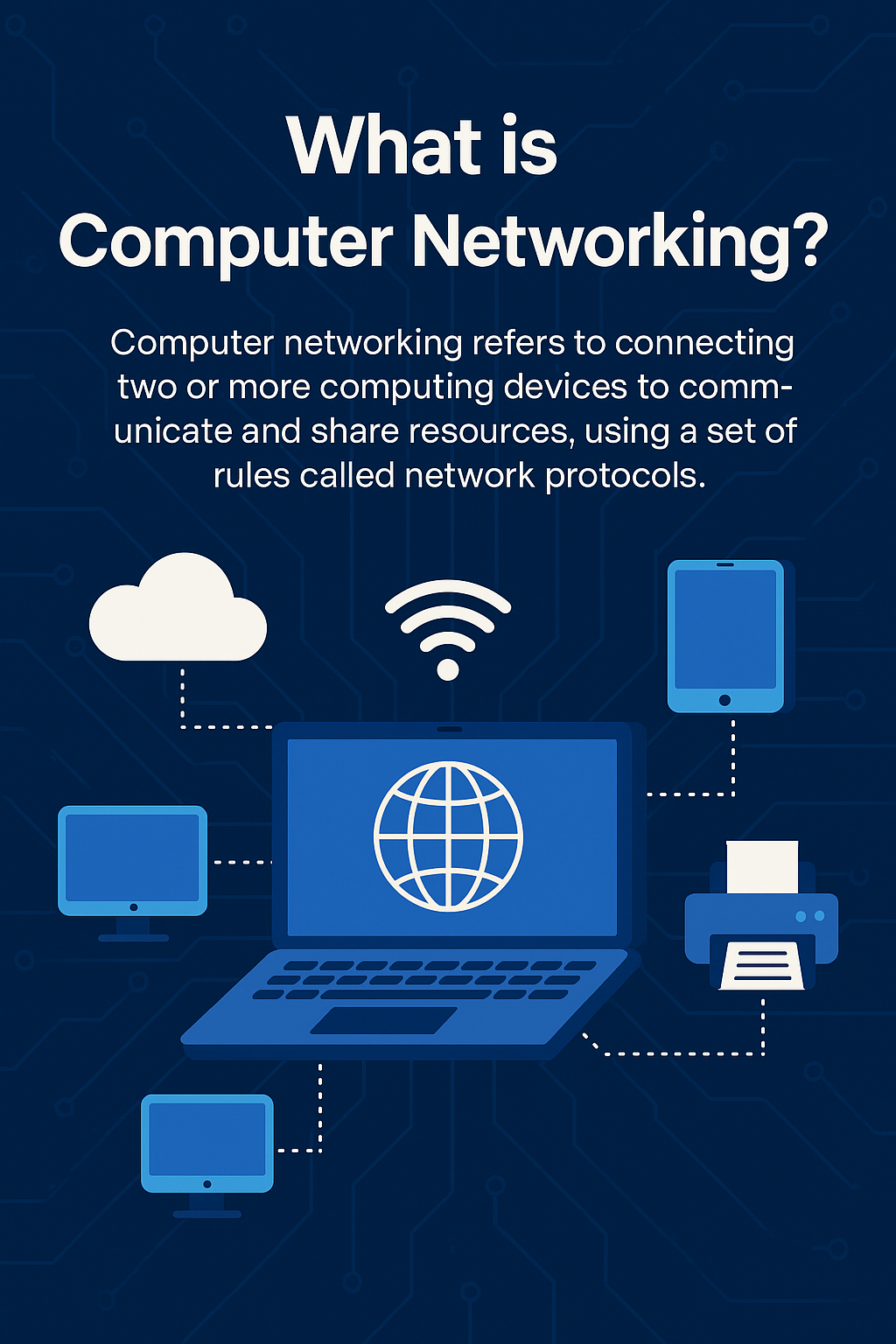

What is Computer Networking?

Computer networking is the process of connecting two or more computing devices (like computers, routers, switches, printers, or servers) so they can communicate and share resources. These networks allow devices to send and receive data using a set of rules called network protocols.

Continue Reading

Finschool Updated Blog

Dec 31 2024 | Written by John Carter

New Blog is lorem ipsum la tobo inka paola ini lafasa mupins hayara mipaka

Continue Reading

Market Updates

May 16 2024 | Written by Sheez Afiz

Stock Market LIVE Updates | NCC up 7% on robust Q4 earnings

NCC reported a robust performance in Q4 FY24, with adjusted PAT hitting Rs 244 crore, up 37% from the previous year. The reported net profit included an impairment of Rs 56.6 crore related to TAQA investments. In Q1 FY25, NCC received Rs67 crore for the Vizag deal, with an additional equity of Rs33crore expected in FY25. A debt portion of Rs 350 crore is slated for receipt by March 2026. Anticipating a 15% revenue growth in FY25, NCC expects inflows of Rs 20000-22000 crore due to general elections and a strong order backlog of Rs 51800 crore, equivalent to 2.8 times TTM revenues as of March 2024.

The standalone gross debt was Rs 1000 crore in March 2024. NCC aims to reduce debt further to Rs500 crore by March 2025. JM Financial projected higher revenues and reduced debt levels led to a 9% and 13% increase in estimated PAT for FY25 and FY26, respectively. Maintaining a BUY recommendation, the revised price target is Rs285.

Continue Reading

Structural positives are much stronger than seasonal headwinds: 6 largecap cement stocks with upside potential of up to 48%

Apr 03 2024 | Written by Stock Market specialist

It took 36 years for India’s largest cement company to take its capacity to 100 million tons.To build the next 50 million tons capacity it took just 5 years. This probably sums up many things as far as the cement industry is concerned and to some extent the Indian economy. Whether it was a change in the demand matrix, which made this company push its capacity so high in a short span of time. Also it is an indication of a trend of lower cost of capital which is the biggest enabler for economic growth. On the other side the sector keeps getting hit with seasonal headwinds, like rise in oil price or floods which led to lower demand in some regions some times. But this time, for a change, even the headwinds are turning to be short lived. The biggest change being the fact that the industry has seen an uptick in prices even when new capacities have come up.

Continue Reading

Curious About the Stock Market? Here's What You Need to Know!

Feb 22 2024 | Written by Stock Market

Welcome to our Stock Market Education Series! If you're new to the world of stocks and investments, you're in the right place. In this beginner-friendly guide, We'll explain the basic ideas of the stock market and guide you as you begin your journey into the exciting world of investing.

What is the Stock Market?

Companies need money to grow. They ask people to invest in their company by buying shares. When you buy shares, you own a small part of that company. If the company does well, the value of your shares can go up, and you might make money when you sell them. If the company doesn't do well, the value of your shares can go down. The stock market is like a store where you can buy and sell these shares. People try to buy them when the price is low and sell them when the price is high to make a profit. It's like owning a piece of a company and hoping it becomes more valuable over time.

How Does It Work?

Companies Issue Shares:

Companies issue shares as a way to raise funds. When you buy shares, you're essentially becoming a part-owner of that company.

Buyers and Sellers:

There are people who want to buy shares (buyers) and people who want to sell shares (sellers). The stock market brings these buyers and sellers together, facilitating transactions.

Stock Exchanges:

Picture stock exchanges as the online platforms where shares are traded. Examples include the National Stock Exchange (NSE) and BSE.

Why Invest in Stocks?

People invest in stocks for the possibility of:

Earning Profits:

When a company does well, its stock price tends to rise. Investors can sell their shares at a higher price, making a profit.

Ownership:

By owning stocks, you have a stake in the company's success. Some companies share their profits with shareholders through dividends.

Understanding Risks and Rewards:

While investing can be rewarding, it's not without risks. Stock prices can go up and down due to various factors. It's essential to learn about these risks and develop a sound strategy for investing.

Conclusion:

Now that you understand the basics of the stock market, get ready to start your investing adventure! Keep an eye out for our next posts, where we'll talk about different types of trading, techniques, and tips for making smart decisions. If you have any questions or specific topics you'd like us to cover, feel free to reach out. Happy investing and learning!

Continue Reading